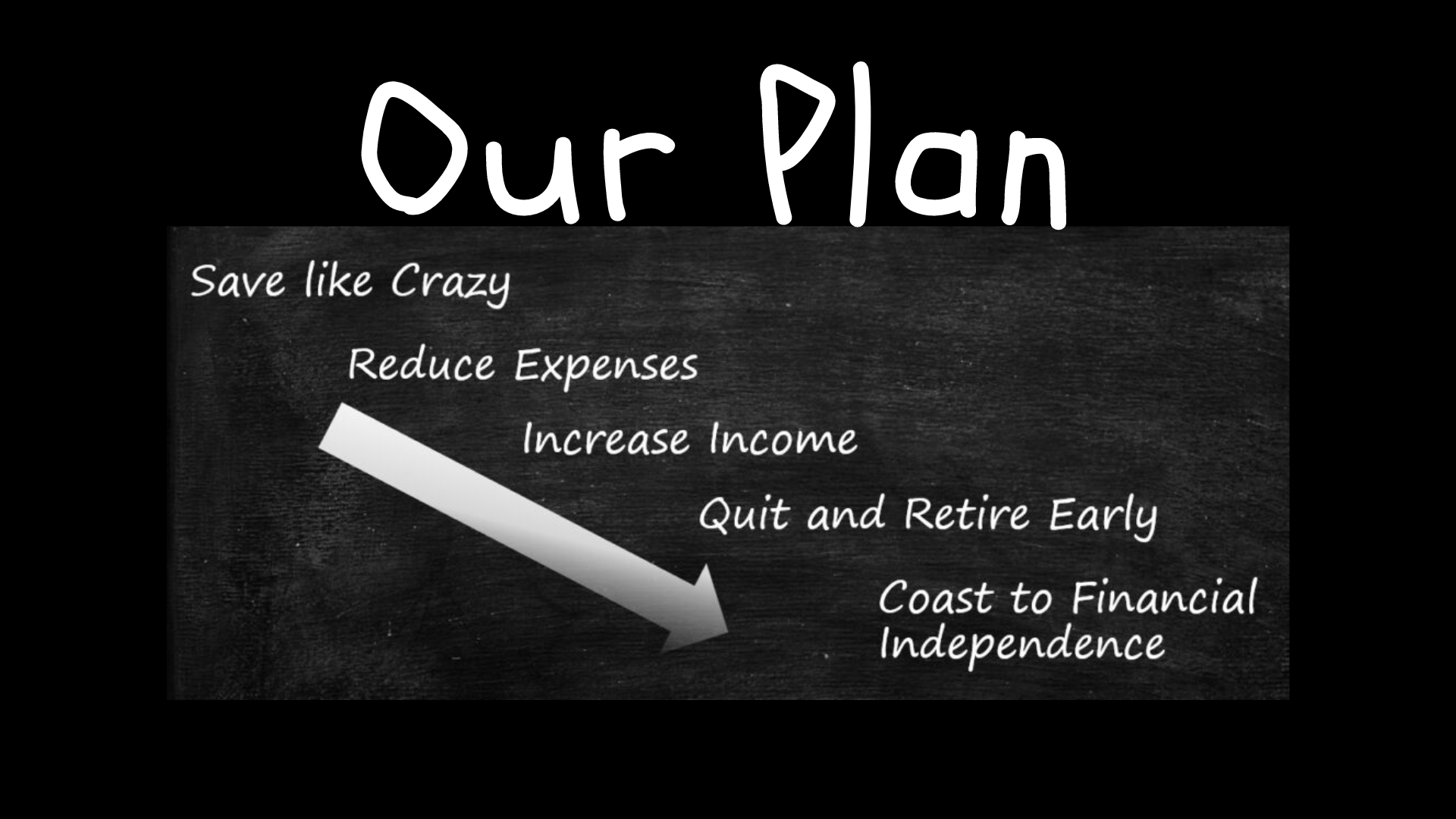

Our Plan

Disclosure: Post may contain affiliate links, meaning we earn a small commission if you make a purchase, at no cost to you. As an Amazon Affiliate, we earn from qualifying purchases.

This plan represents the next step in our financial and family journey. It is a continuation of many years of preparation (mostly not knowing what we were preparing for). In 2019, we became aware of a grand adventure called America’s Great Loop, a 6,000 mile boat trip that circumnavigates the East Coast of the United States.

Being “on the path to FI (financial independence)” gave us the flexibility to adjust our plans and pivot to be able to go on this epic adventure as a family. Had we not been on this path already, it would still be possible but our time horizon would be much longer. We invite you to follow along as we share our story with you!

What is our Master Plan?

Save Like Crazy

It is no surprise that undertaking a grand adventure such as the Great Loop requires substantial financial resources. Because we really believe in living a life without debt and the freedom that brings, we need to save up the money to do this. That sum comes in two parts: 1) money to buy our Great Loop boat, and 2) money for one year of living expenses while we’re on our adventure.

We estimate that a suitable boat for a family of four capable of doing this journey will cost around $100,000. Because we live on a budget now, we know exactly what we spend each month, so estimating one year of those expenses for our trip will be fairly easy. We’ll throw in a hefty emergency fund as well as some extra savings for fun on our trip, and that’s how we have come up with the total we need to save to make this dream a reality.

Reduce Expenses

There are two benefits to reducing our monthly expenses: 1) it makes saving the extra money easier, and 2) it works out our “gazelle intensity” muscles that may have gotten a little flabby since Baby Step 7.

Generate Extra Income

Any extra income we can earn while saving moves us closer to our goal. We have a variety of side hustles in the works to help add additional income to what is already coming in through my day job. We also intend to sell so much on Craigslist that the kids think they’re next (as we did during our baby steps to get out of debt).

Quit and “Retire Early”

The point at which we meet our savings goal is when things get really exciting. This is when I quit my day job and “retire early.”

For us, early retirement will look like a year long boat adventure as a family.

Coast to (FI) Financial Independence

If you read much about the FIRE movement, you’ll notice that we’ve got this backwards. Of course, you are supposed to first become financially independent and THEN retire early. (FI+RE) What’s so great about FIRE is that there is no single defined path. It’s a choose your own adventure, really. Even being on the path to FI at all give you incredible flexibility. In our case, the master plan prescribes a hybrid approach so it’s not exactly textbook FIRE (and that’s okay – great even).

We want our freedom now instead of later. We want to spend time with our children now before they leave the nest and go off to college. We want to adventure before we’re too old to truly enjoy it. We want to journey while our health is good. It’s definitely not the same as someone who lives paycheck to paycheck or goes into debt because they don’t have the gumption for delayed gratification. Or someone who won’t sacrifice today to afford a better tomorrow. We simply want to cash in our decades of hard work financially because we’ve earned it. Our feeling is that if we continue on our path, another five or so years would get us to traditional FI. But we fear that at that point, we’ll have an empty nest, and unknown health (but a pile of money). That may work for some people and it was actually the path we were on before last year. But we believe if that happens in our case, we will have been “doing it wrong.” For onFIREfamily, it’s RE and then FI will follow. We want to escape the rat race (not win it), live unconventionally, and enable the time freedom we seek and stop trading time for money.

But how will you get to FI if you don’t have an income?

Introducing the amazing power of compound interest! By living debt free and cash flowing our year-long adventure, our traditional retirement accounts remain untouched and continue to grow at (pick a number you’re comfortable with) 8%. With that big flywheel saved over a 25 year career of careful budgeting and high savings rate, without adding any additional savings, we’ll “coast” to financial independence. For us, that might take about five years or so.

In the meantime, we use a lifetime of budgeting, savings, side hustle, and frugality skills to fund our (already low because we’re debt free) living expenses. If that doesn’t work, because life has a way of surprising us, there’s always getting another job and hopping back on the more traditional “work until you retire” plan.

That’s our plan. Thanks for coming along for the adventure! We’ll share more as we navigate our way through this and update you as we progress and the plan changes. That’s part of the fun!